For nostalgia Tuesday today, I will focus on our national debt. Why? Republicans will make this a crisis matter because our borrowing limit has been reached. While they might have a point, Republican presidents have tended to have caused this problem, and anyway, the whole concept of debt being bad might not be all that true.

For nostalgia Tuesday today, I will focus on our national debt. Why? Republicans will make this a crisis matter because our borrowing limit has been reached. While they might have a point, Republican presidents have tended to have caused this problem, and anyway, the whole concept of debt being bad might not be all that true.- This debt could well very shortly zoom past $31.5 trillion, or $94,210/person.

- Was $1 trillion in 1982 and $10 trillion in 2008.

- The four highest annual budget items.

- Medicare/Medicaid: $1.5 trillion.

- Social Security: $1.2 trillion.

- Defense/War: $0.8 trillion.

- Interest on this debt: $0.5 trillion.

- The sources of revenue for our Federal government:

- Individual income tases 50%.

- Corporate taxes 7%.

- Payroll taxes that fund social insurance programs 37%.

- Click on THIS to see how the USA compares with other nations.

- As one of those graphs below shows, Republican presidents have been responsible for most of this current debt.

- In the bottom graphic:

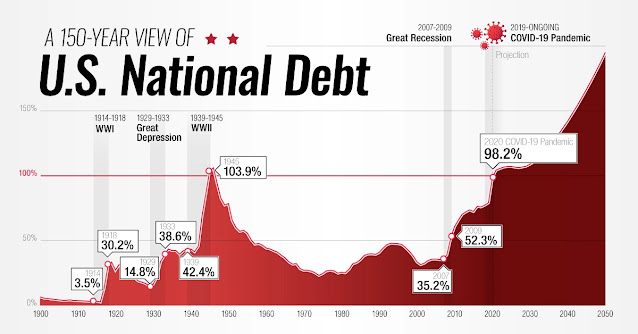

- When I began teaching at the University of Hawaii, the U.S. debt/GDP % was less than 20%.

- When I retired in 1999, this was up to 30%.

- Today, the number is just around 140%.

- Japan, too, is around 140%, and I don't see any dangerous imbalance.

- However, this number differs widely by source of information, for Wikipedia shows a General Government Gross Debt as % of GDP of:

- #1 and #2 Afghanistan and Syria

- #3 Japan 263%

- #4 Venezuela 241%

- #5 Greece 199%

- #8 Singapore 160%

- #14 USA 128%

- #20 Canada 113%

- #66 China 72%

- 100 Thailand 58%

Let me start with a few historic graphs:

Nearly a dozen years ago I posted in the Huffington Post A SIMPLE SOLUTION FOR OUR NATIONAL DEBT.

- The debt limit was $14.3 trillion, less than half of today.

- Income tax as % of earnings was 23.4%. Today, 28.4%. Belgium is at 55% and New Zealand a bit more than 20%.

- A person who made $100,000 in 2010 paid $23,600 in taxes. A single filer today would pay only $17,836 In 1990, this $100,000 filer paid $27,300!

- The average income tax paid in 2010 was around $10,500, same as in 1990. Today, $15,300.

In any case, I ended with the following:

THUS, THE SIMPLE SOLUTION ABOUT OUR NATIONAL DEBT IS TO KEEP INCREASING IT, BUT MAKE SURE THAT THE INTEREST WE PAY REMAINS LOW. When inflation comes, we then lend rather than borrow. This could mean jumping the $23.6% to 27% and higher, but that would make for good fiscal sense. As the money we borrowed at 3% remains 3%, we would, actually, be ahead, for these funds can be invested at the inflated percentage. These extra moneys then lent could provide a nice added income. DOES THIS MAKE ANY SENSE???

That comment was reinforced by my Huffington Post article of 2010 on How Serious is Our National Debt?

- Is there a check and balance system in place or can our national debt keep going up forever? The answer is yes, for Congress needs to approve it, and yes, again, because it always does when asked by the President. But this is where the U.S. House can become a serious problem.

- In 2010 China owned 23% our foreign debt, with Japan 21%. However, foreigners only owned 25% of our national debt. 75% was owned by us. Or, in total, China owned 5.8% of our national debt.

- In May of last year, Japan held $1.3 trillion of our debt, with China #2 at $1 trillion. Dividing by 30, this means China owns 3.3% of this debt, quite a bit less than in 2010.

That was so tedious that I thought I'd end with this UFC fight between 169 pounder Daiju Takase vs 600+ pound Emmanuel Yarborough. Want to guess who won? Watch this. If you want to read about this match, click on this.

-

Comments

Post a Comment