First a few comments about the Supreme Court yesterday giving any U.S. president immunity for any criminal act:

First a few comments about the Supreme Court yesterday giving any U.S. president immunity for any criminal act:

- All future Trump trials will be delayed until next year or never be held.

- That sentencing by Judge Juan Marchen scheduled for July 11 has been delayed until September 18.

- One of many frightening quotes, and this one from Associate Justice Sonia Sotomayer:

Leading the liberals, Justice Sonia Sotomayor outlined hypothetical situations where the concept of immunity could apply.

"Orders the Navy's Seal Team 6 to assassinate a political rival?" she wrote. "Immune."

"Organizes a military coup to hold onto power? Immune. Takes a bribe in exchange for a pardon? Immune. Immune, immune, immune."

- He could step down, leading to what the Democratic Party can do at their national convention in August.

- Could himself nominate Kamala Harris

- Allow for an open convention, with the most popular candidate prevailing.

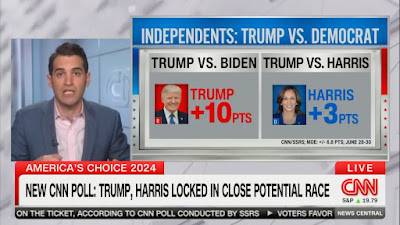

- The latest available survey by CNN after that debate, shows several other younger Democrats doing better against Trump, with Harris by far the best.

- Better to do this now, rather than wait until the Chicago gathering beginning of August 19.

- He could count on the fear factor I described yesterday to remain as the Democratic candidate on November 5, which is a little more than four months away.

- Here is how I ended that posting.

- Following up on Associate Justice Sotomayer's dissenting plea above, if in late October polls show that he is hopelessly behind Trump, he could NOW LEGALLY order the Navy's Seal Team 6 to assassinate him. Of course, we are talking about Joe Biden, and something like this will not even come up for discussion, for here is how he reacted to that Supreme Court's decision.

- But more seriously, can you imagine where the country will go if Donald Trump is re-elected? That is the fear factor that, I think, will prevail for Biden.

Some Nvidia history:

- Founded in 1993 by Jensen (Jen Hsun) Huang, a Taiwanese-American electrical engineer, Chris Malachowsky from Sun Microsystems and Curtis Priem from IBM and Sun Microsystems. They met at a Denny's roadside diner in San Jose to start the company.

- Why Denny's?

- Huang came to the U.S. at the age of 10 only with his brother. He had an up and down youth, finally graduating from Aloha High School in Oregon.

- Got his first job as a busboy at Denny's.

- Went on to Oregon State, then a master's degree from Stanford.

- Huang became the head of their startup in Sunnyvale, California.

- Began with $40,000 in the bank, and got $20 million of venture capital funding from Sequoia Capital and others.

- Company had no name, and used NV in their files.

- Starting with that, they chose NVision...but that name was already taken by a toilet paper firm.

- Huang suggested Nvidia, from the latin word for envy, invidia.

- Almost went bankrupt in 1997.

- Curtis Priem (left) essentially left Nvidia after a decade, and gave his worth mostly to Rensselaer Polytechnic Institute. He would have been the 16th richest person in the world at $70 billion if he had remained.

- Today, Chris Malakowsky (right) is the equivalent of a senior president at Nvidia, and is a billionaire.

- 31 years later, Huang, now 61, remains as CEO. He does not keep a fixed office, and largely roams their headquarters

- During the recent AI boom, Huang's net zoomed from $3 billion in 2019 to $90 billion in May 2024. Mark Zuckerberg of Meta, is worth $177 billion, and sent out an Instagram of the two, saying Jensen is like Taylor Swift, but for tech.

- Huang lives in Los Altos Hills, but has had a second home in Wailea, Maui since 2004. Reported to have just acquired a mansion in San Francisco for $40 million.

- Moore's Law predicted that the number of transistors in a central processing unit doubles every two years. Graphic to the right. Huang's Law states that the performance of graphics processing units will more than double every two years. He observed that Nvidia's GPU were 25 times faster than 5 years ago.

Market Cap Price

#1 Microsoft (MSFT) $3.394T $456.73

#2 Apple (AAPL) $3.323T $216.75

#3 NVIDIA (NVDA) $3.057T $124.30

#4 Alphabet (GOOG) $2.271T $184.49 (Google)

#5 Amazon (AMZN) $2.052T $197.20

#6 Saudi Aramco (2222.SR) $1.807T $ 7.47 (Saudi Arabia)

#7 Meta Platforms (META) $1.280T $504.58 (Facebook)

#8 TSMC (TSM) $0.894T $172.33 (Taiwan)

#9 Berkshire Hathaway (BRK-B) $0.874T $405.19

#10 Eli Lilly (LLY) $0.823T $914.37

#12 Tesla (TSLA) $0.699T $209.86

#13 Novo Nordisk (NVO) $0.655T $145.42 (Denmark)

#15 Walmart (WMT) $0.543T $ 67.48

#17 Exxon Mobil (XOM) $0.505T $114.96

#19 Tencent (TCEHY) $0.446T $ 47.44 (China

#20 ASML (ASML) $0.408T $1,033 (Netherlands)

#22 Oracle (ORL) $0.394T $143.61

#23 Samsung (00593.KS) $0.391T $ 59.14 (South Korea)

#25 LVMH (MC.PA) $0.382T $764.85 (France)

#34 Toyota (TM) $0.274T $203.71 (Japan)

#35 Nestlé (NESN.SW) $0.267T $101.73 (Switzerland)

#50 Pepsico (PEP) $0.223T $162.89

#75 Tata (TCS.NS) $0.173T $ 47.69 (India)

Click on the source. Very interesting to see where Costco, Home Depot, Netflix, Coco-Cola, Shell, McDonald, Abbott Laboratories, Walt Disney, Bank of China, Alibaba and General Electric rank.

In case you did not know, market capitalization is the value of a company that is traded on the stock market multiplied by the total number of shares. There are are other rankings, such as by annual revenues:

- #1 Walmart $611B

- #2 Saudi Aramo $604B

- #3 Amazon $575B

- #4 State Grid Corp. of China $530B

- $5 Vitol $505B (commodities, Switzerland)

- The U.S. has four companies in the top ten. China has three.

- Five out of the top ten are oil and gas fossil fuel corporations.

- When a company wants to takeover another, market capitalization is best in terms of value.

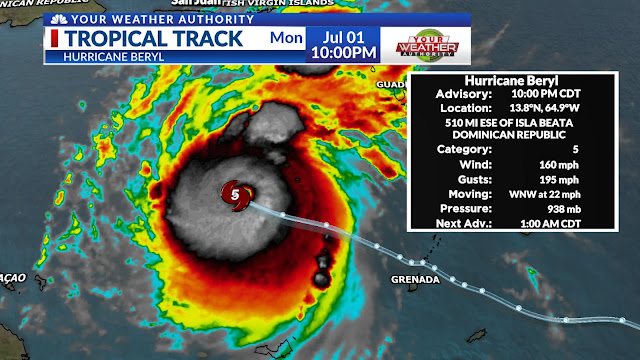

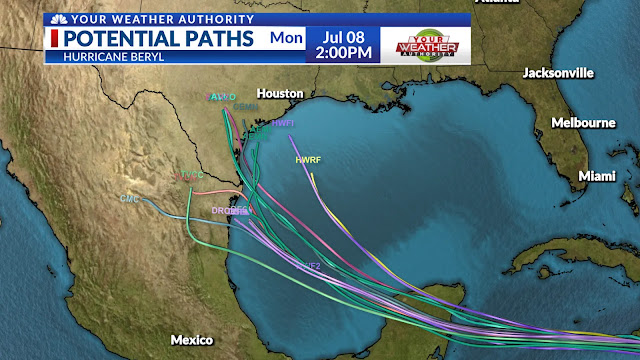

Super Hurricane Beryl is awesome. The good news is that wind speeds were up to 165 MPH earlier today, but seem to have now declined to 155 MPH.

-

Comments

Post a Comment